Understanding The Application Refine For Loans Without Credit Scores Checks

Author-Kryger Healy

There are many lenders that supply no credit check car loans. Make certain to evaluate interest rates, fees, car loan terms and consumer evaluations prior to selecting one.

No credit history checks mean that your loan provider can accept you based on various other factors, such as employment standing, revenue or savings account history. However, these loans usually have negative funding terms.

Just how to Use

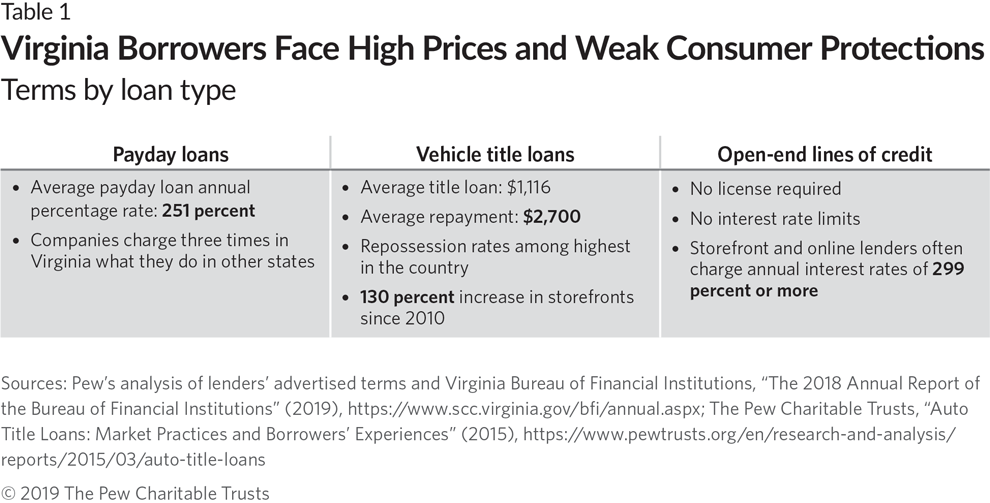

No credit rating check car loans are an excellent way to access funding when you need it the most. These finances are designed to help you avoid high interest rates, fees, and financial debt traps that can feature other types of economic products like payday or auto title fundings.

Unlike traditional individual lendings, no credit history check lenders do not run a difficult credit scores inquiry when you use. This allows you to obtain accepted for a financing more quickly and with less effect on your credit history.

installment loans no credit check direct lender of no-credit-check loans are used through online applications, but some lenders might additionally provide in-person or over-the-phone applications. You will require to offer basic info such as your name, address, and earnings information when obtaining a no-credit-check financing.

No-credit-check car loans commonly have shorter settlement terms than individual financings from typical loan providers. This enables you to repay the finance and avoid passion costs much faster. Nevertheless, be sure to make your settlements on time, as missing out on also one payment can result in pricey costs and financial debt cycles.

Documents You'll Require

The application procedure can vary from loan provider to lender, yet normally requires a variety of papers including your name, contact details, social security number and checking account details. Some loan providers additionally need a duplicate of your government-issued ID.

Fundings without a credit scores check deal borrowers that may not fulfill basic personal car loan demands a possibility to borrow cash swiftly. However, it's important to comprehend that these financings typically come with high interest rates and damaging settlement terms.

Payday advance loan are an usual kind of no debt check finance that can be made use of to deal with urgent financial requirements till your next payday. Nonetheless, the high rates of interest connected with these kinds of finances can commonly catch debtors in a cycle of financial obligation. It's best to study various other options, like personal installation car loans or charge card, that provide affordable rate of interest for borrowers with inadequate to fair credit history. Generally, these fundings have less restrictive payment terms and are much less pricey than no credit rating check lending choices.

Requirements

No credit scores check car loans are a type of individual loan that does not include a tough query on your credit score report. Instead, online loans no credit check check out other variables, like earnings and work status, to figure out whether you can manage to repay the finance. https://squareblogs.net/shelia88freeman/reliable-techniques-for-making-use-of-loans-without-credit-report-checks-to of loans often tend to have higher rate of interest than traditional lendings and may feature even more stringent settlement terms.

Before applying, assess the lender's terms and conditions and compare their APRs to other lenders'. Some states have legislations that secure customers from aggressive lenders that charge inflated rates of interest and costs.

Likewise, if the lender asks you to pay cash ahead of time or will not disclose their charges, it's a red flag that they may get on the wrong side of the law. Usage WalletHub's totally free individual financing pre-qualification tool to examine your chances of authorization prior to applying with a details loan provider.

Fees

Lenders that offer no credit history check fundings typically look at other information factors than those in your traditional credit record to decide on your application. This can imply that they have much shorter turnaround times and are able to authorize applicants quicker. Nonetheless, it additionally means that the finance terms can be undesirable and cause high interest rates and fees.

The bright side is that you can prevent predative lenders by diligently researching your alternatives and shopping around for the very best funding terms. WalletHub recommends that you take into consideration an individual lending from a reliable lender that supplies reduced, affordable interest rates and affordable APRs.

You can start by using WalletHub's complimentary individual lending pre-qualification device to see your chances of approval with a number of lending institutions simultaneously. This will only impact your soft credit rating, and it's a wonderful method to see your prices prior to you obtain a no-credit-check finance. In addition to discovering an excellent lender, you'll want to see to it that you can manage to repay the car loan within the required payment term.